Overview

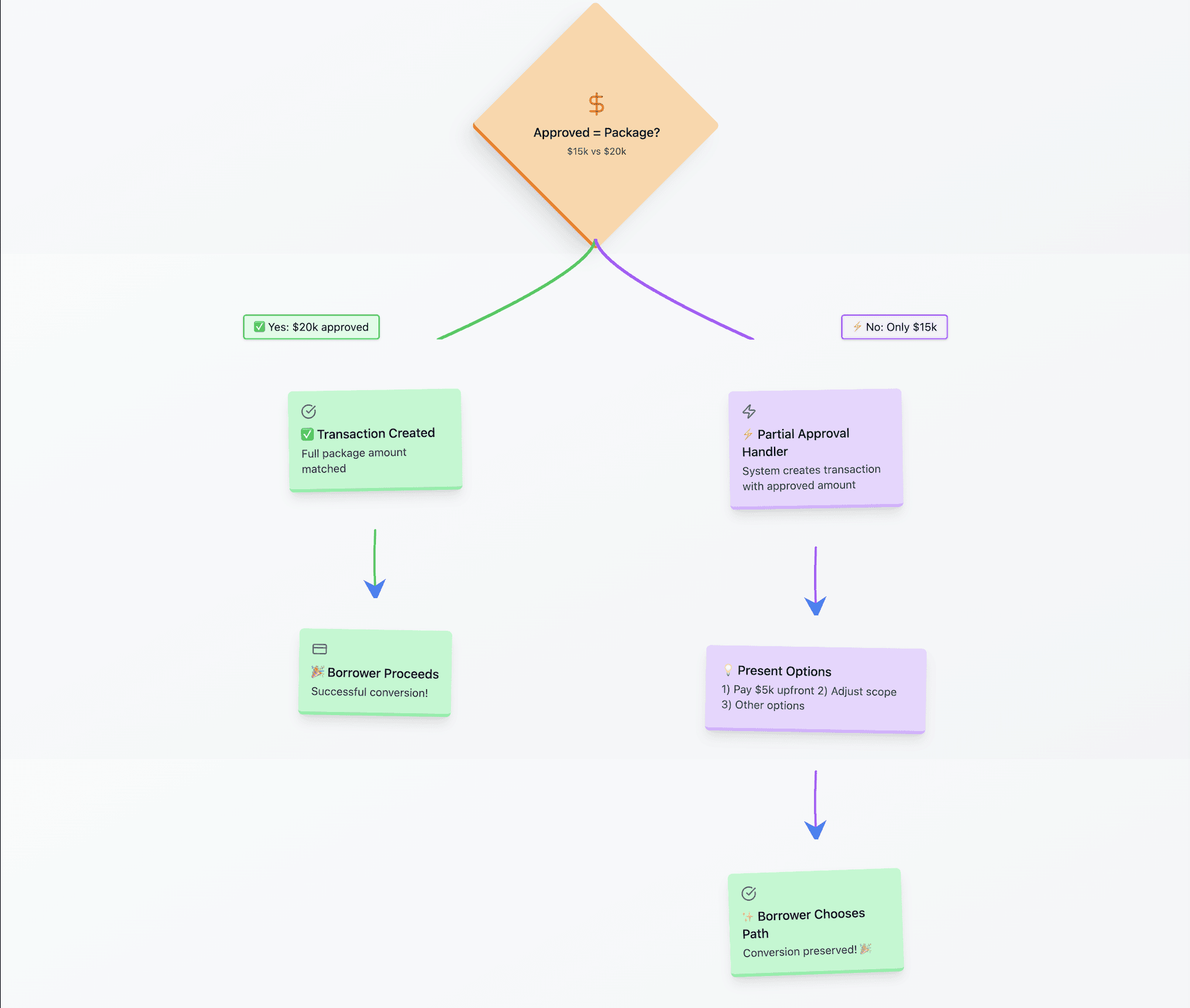

Some partner practices use PatientFi’s EMR URL Flow to create transactions directly within their systems. However, when borrowers are approved for less than the requested loan amount, the flow currently failed—leaving both the borrower and the practice without a clear path to complete the transaction.

To solve this, we designed and implemented an “Approved Less Than Requested” flow that allows borrowers to proceed by paying the remaining balance out of pocket.

Problem

Partners often offer fixed-price treatment packages (e.g., $20,000). When a borrower is only approved for a portion of that total—say $15,000—our existing system couldn’t handle the discrepancy.

This led to:

Failed transaction creation

Borrowers encountering a dead-end experience

Practices losing potential conversions

At the time, only a small subset of providers had access to an experimental feature flag (“App + Trans”) that could partially support this use case.

Goal

Enable borrowers to proceed even when approved for less than the requested amount by offering a simple decision point that lets them cover the remainder out of pocket — without disrupting the EMR transaction flow.

Design Approach

We introduced a new interstitial screen between the approval and transaction creation steps to handle partial approvals gracefully.

Proposed Flow

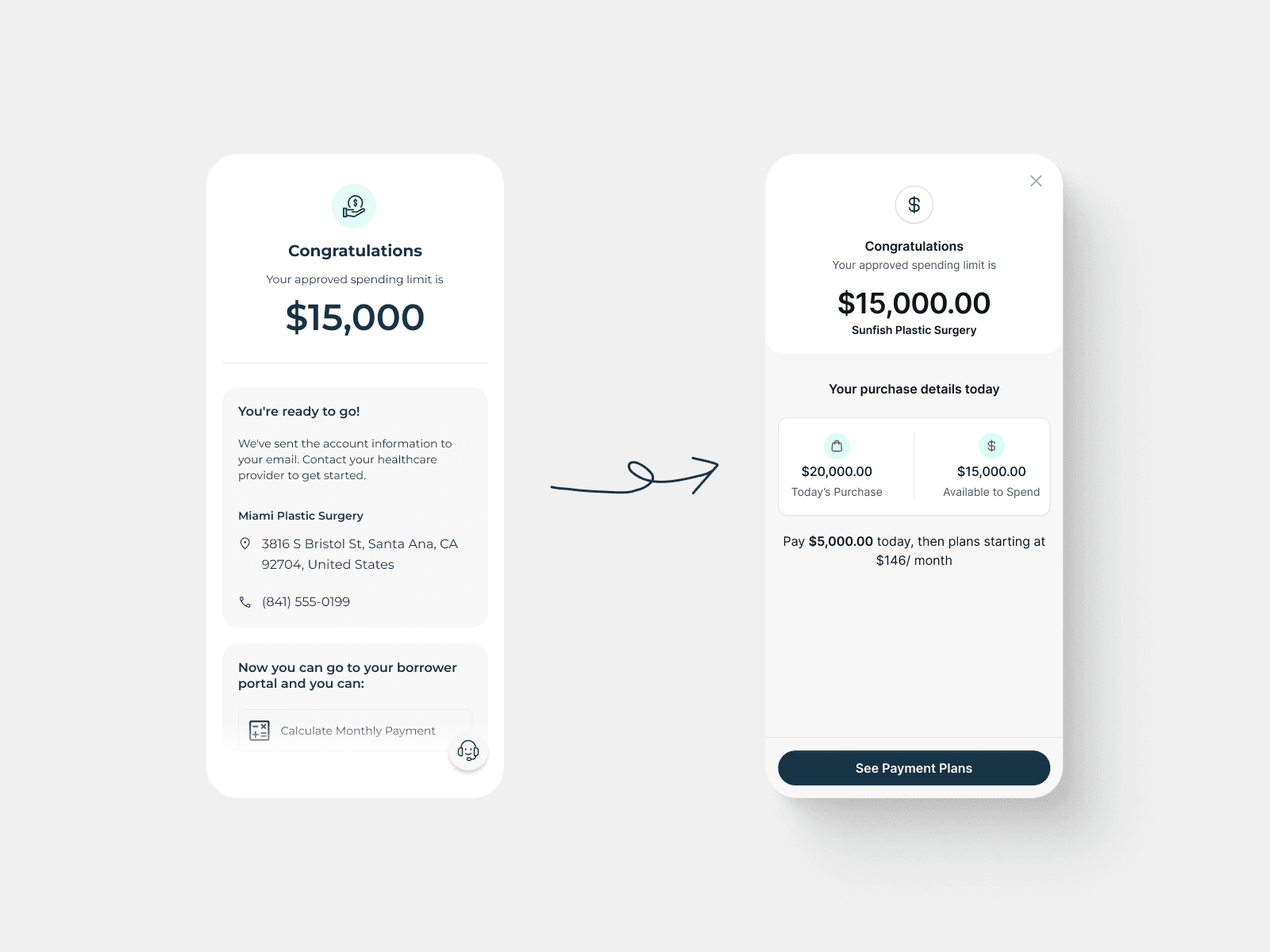

Approval Result: The borrower receives a message indicating partial approval (e.g., “Approved for $15,000”).

Decision Screen:

Message: “We were able to approve you for $15,000. Your total cost is $20,000, so your remaining balance would be $5,000. Would you like to continue?”

Options:

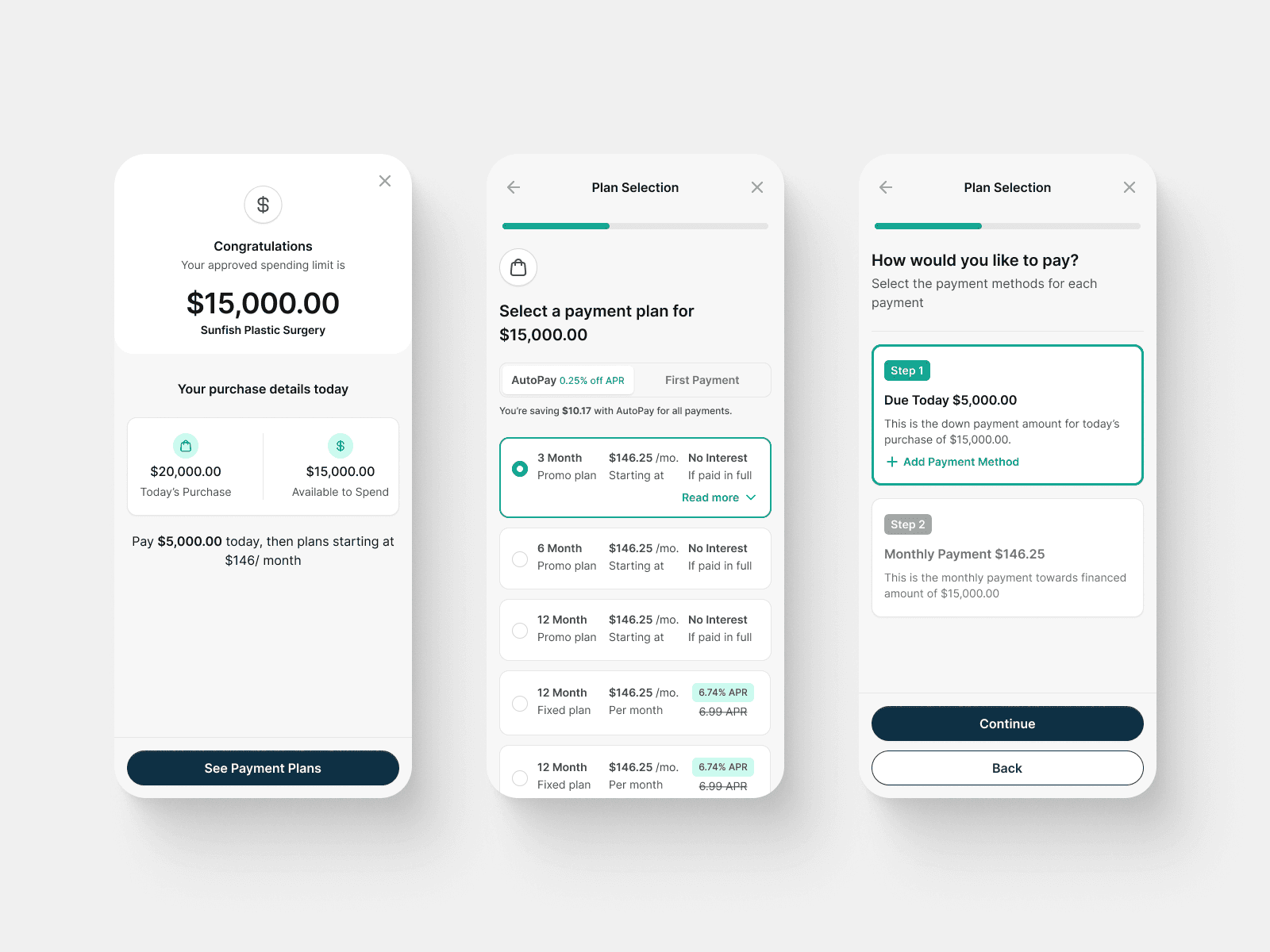

Continue: Borrower agrees to move forward with the $15,000 loan.

Cancel: Borrower exits the flow.

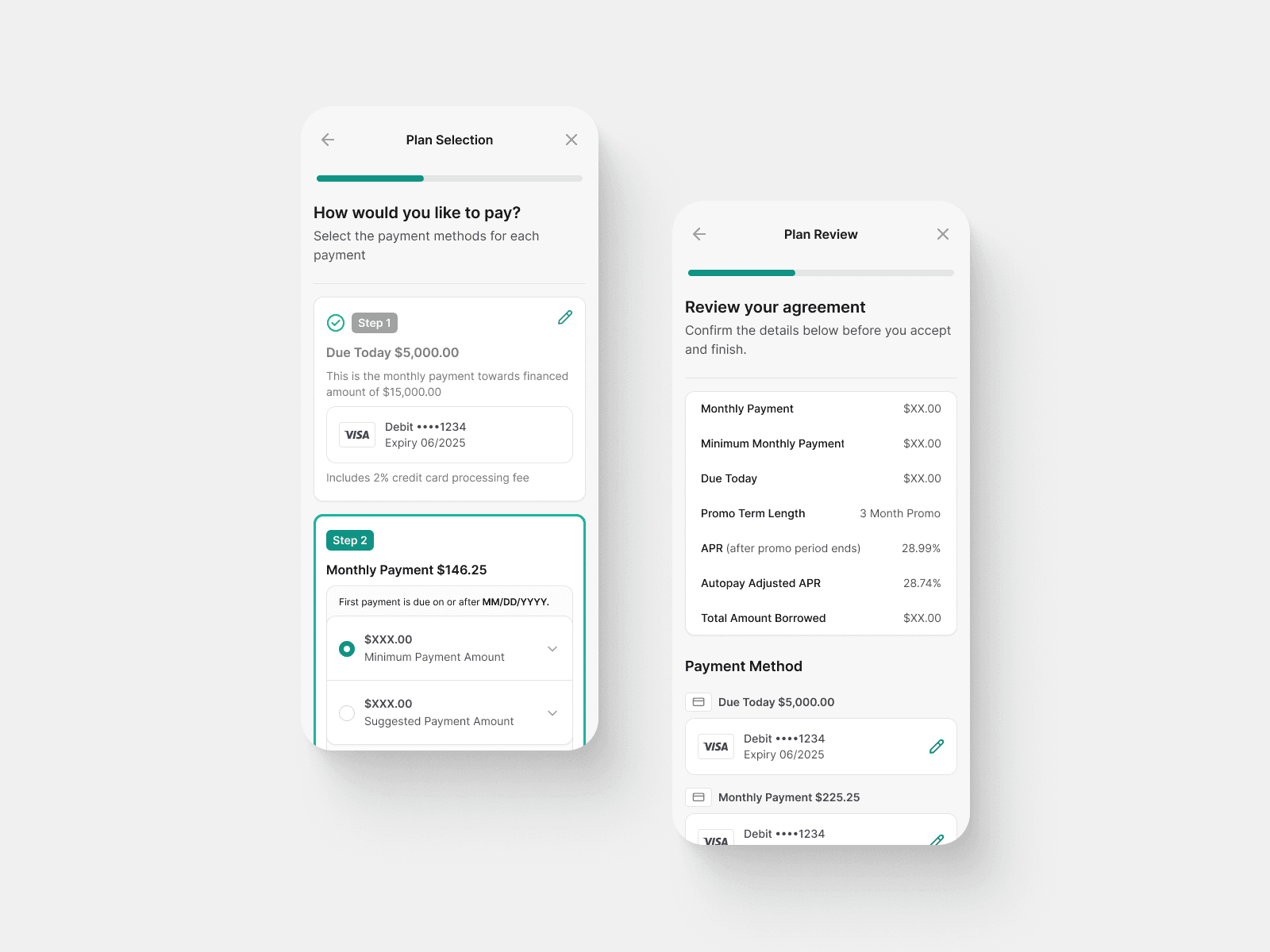

Transaction Update: Selecting Continue triggers an API call adjusting the transaction from $20,000 to $15,000.

Completion: The flow continues as normal, leading to the transaction confirmation screen.

Implementation Details

Feature Flag: Controlled by “App + Trans,” allowing selective rollout to partner groups.

Partner Logic: Fixed package pricing required dynamic recalculation of out-of-pocket amounts.

Collaboration: Partnered with engineering to ensure accurate transaction adjustments and seamless API integration.

Outcome

Enabled successful transaction completion even when approvals were less than requested.

Reduced flow abandonment and practice friction during checkout.

Established a scalable design pattern for future partner implementations.

Key Learnings

Anticipating and designing for edge cases improves borrower trust and partner satisfaction.

Transparent communication of approval amounts and next steps reduces confusion and support calls.

Using feature flags enables safe, iterative validation of complex financial experiences.